- Published on

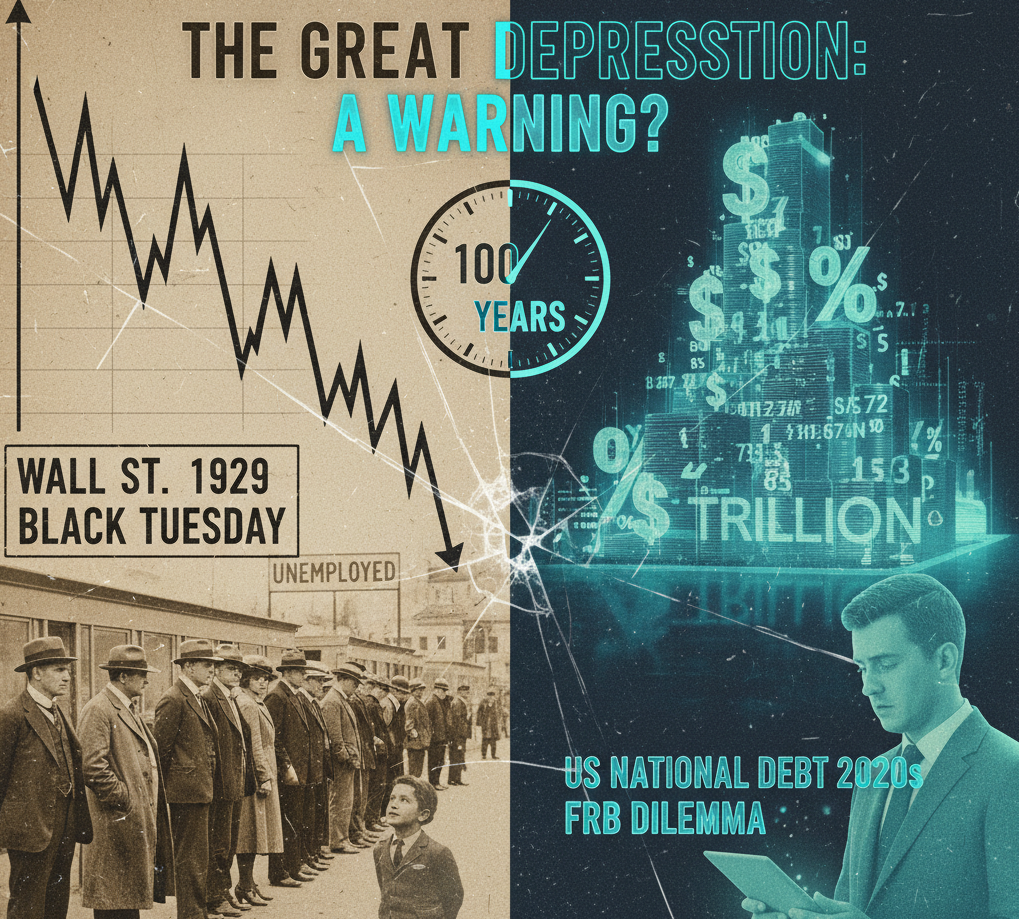

[World Bubble Encyclopedia Vol. 3] The Day the World Broken in 1929: Is the Great Depression 100 Years ago a Warning to the Modern America?

"History doesn't repeat itself, but rhymes."

Every time I see the news of the astronomical rise in the US national debt and the monetary easing to support it, I get the impression of a certain era, 100 years ago. Yes, it's the "Roaring Twenties."

The huge bubble was swelled by the boom that was thought to last forever, a thrill for new technology, and debt. The end of that glorious era has plunged the world into the unprecedented darkness of the Great Depression.

This is a story that looks back on the tragedy that occurred 100 years ago. And it is a slightly courageous attempt to reflect our present-day views in the mirror of history.

Roughly speaking

- **In the 1920s, the United States was thrilled by a double bubble of land and stock, and "even a shoe-shining boy spoke about stocks." **

- **Personal "debt (margin trading)" accelerated the enthusiasm to an abnormal level, and its collapse caused the Great Depression. **

- **In today's world where the lead role has changed from "individual" to "nation", what should we interpret from the patterns of history? **

Act 1: The Illusion of an Eternal Good

After World War I, America was booming unprecedentedly as a global factory. Everyone believed that the future was rosy.

Florida Land Boom

The enthusiasm began in a tropical paradise. The moment Florida lands were covered in the story of "Sun and Leisure," speculative money was flooded from across the United States. The plots on the map are bought and sold on cocktail stained napkins without looking at the actual product, and are resold a dozen times a day. It was a passionate prelude of the huge bubble that would later take place on Wall Street.

Wall Street Madness

The main battlefield moves to Wall Street in New York. Expectations for new technologies such as radio and automobiles have pushed stock prices six times, and the whole country has become so popular that it is said that even a shoe-shining boy has spoken about recommended stocks.

This enthusiasm was financed by a margin transaction known as "on call loans." Buy stocks with just 10% margin and borrow the rest. Everyone believed that debt was a shortcut to a dream. A demon called leverage controlled the entire market.

Act 2: Black Tuesday - The day the music stopped

Tuesday, October 29th, 1929. The music on Wall Street stopped completely that day. It was the day of a historic stock market crash that was later called "Black Tuesday."

Trigger of collapse

Why did the crash occur? Wariness about stock prices that have risen too much, anxiety about the future of the economy, and interest rate hikes caused by the Federal Reserve. A variety of factors combined led to the initial sales spread across the market.

That selling opened the door to hell. Investors who had bought stocks through margin trading were flooded with credit cards (margin calls). In order to pay off their debts, they have no choice but to sell their stocks in a panic. The selling will lead to further decline in stock prices and will create new additional proofs.

The more the debt accelerated the enthusiasm, the speed of collapse and its destructive power became incredible.

Act 3: Deja Vu 100 years from now?

Now, here's the main topic. What does this story from 100 years ago tell us today?

From personal debt to national debt

If "personal debt" was the main character that escalated the bubble of the 1920s, then undoubtedly "national debt" supports the modern market. After the Lehman shock and the COVID-19 pandemic, the US government's debt has surged to a level well above GDP.

Personal debts end when an individual goes bankrupt. However, national debt is not the case. Ultimately, this will be borne by the entire nation in the form of inflation and tax increases. We may be forced to sign the enormous bill without us realizing it.

Fed's dilemma

In 1929, the Fed decided to raise interest rates to curb overheating speculation, which was one of the triggers of the collapse of the bubble economy. The modern Fed is also facing a counter-choice dilemma of interest hikes to curb inflation and monetary easing to prevent the economy from recession. History vividly teaches us how tightrope-walking the "exit strategy" of monetary policy is.

Conclusion: History does not teach "answer". But I'll teach you the "game plan"

The 1929 crash destroyed the global economy, but it is also true that a new social system was born out of the ashes. The Deposit Insurance System (FDIC) to prevent banks from bankrupting chains, and the Securities and Exchange Commission (SEC) to protect investors. Much of the "safety net" we enjoy now is born from the scathing lessons we learned from this time.

If that's the case, then I can't help but wonder this. What kind of "new rules" will the outcome of the huge modern national debt problem demand from our society?

Learning from history is not about predicting the future. This involves interpreting the next "tactics" that governments and central banks will take from historical patterns and creating a "game plan" about how to protect their assets and lives.

The story of enthusiasm and despair from 100 years ago asks us, quietly but strictly, as we live in the present.

Do you understand the rules of this game? and.