- Published on

Your greatest chance is when everyone screams "Oh noooo." The rebellion called "cyclical value stocks" investment, picking up diamonds in the burning field of recession

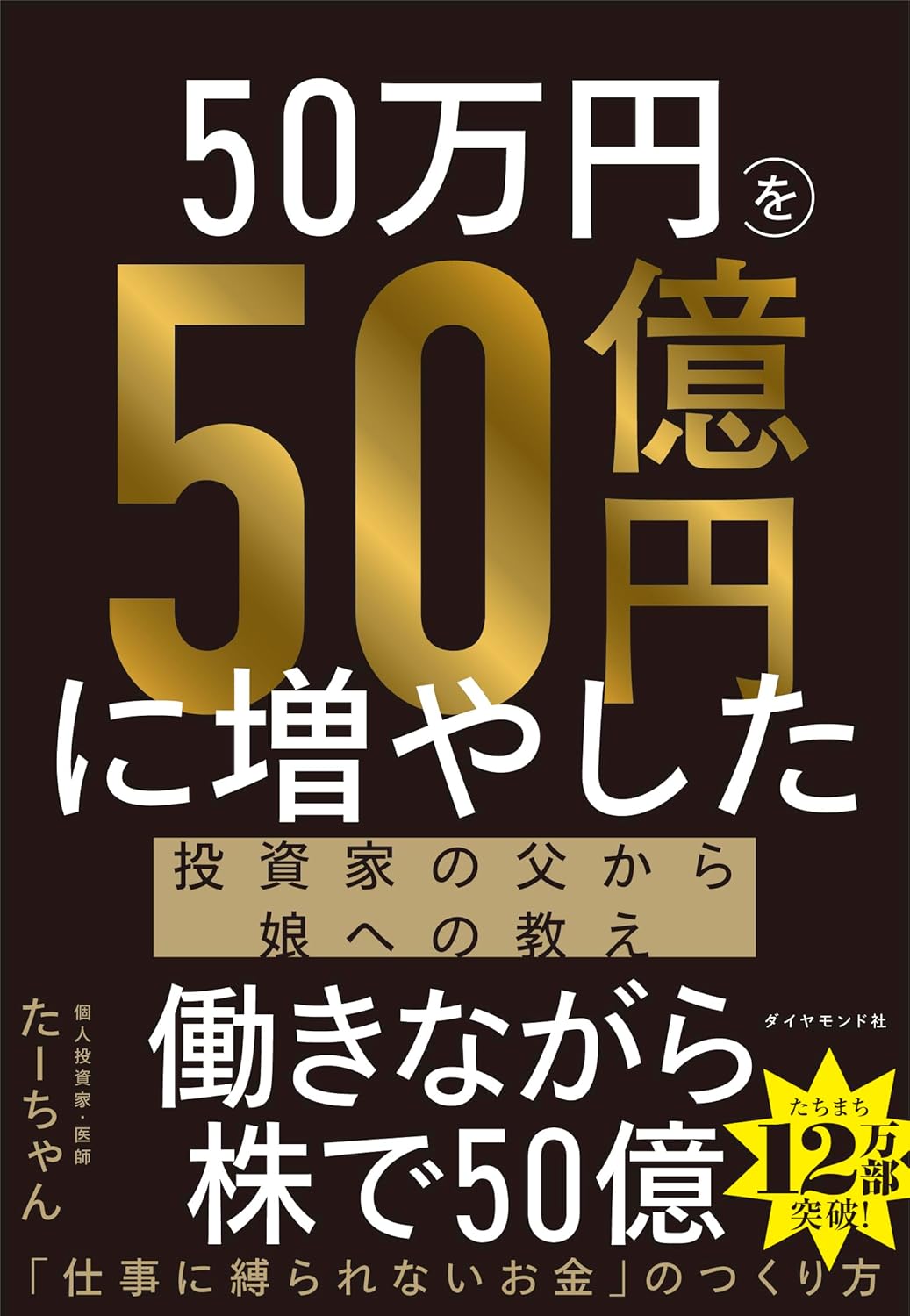

"Ta-chan - Increased 500,000 yen to 5 billion yen A teaching from an investor father to his daughter

"The stocks are over now""It's a historic crash!"

TV commentators are ignoring anxiety, and social media is overflowing with posts of screaming noises. Why did this co-worker, who was so talented, sit next to you, quickly gave up and left before the company tilted?

They knew. That a company ship can sink without caring about the lives of its crew. And before the ship sinks, he had prepared his own "boat" to row on its own.

On the day the market is tinted red, are you terrified and throwing away all your stocks?

But what if the despair of the masses is the "golden invitation" to build wealth? In this article, we talk about the most intelligent and thrilling investment method - Cyclical Value Stocks investment, which goes against the masses and picks up huge returns from the burning fields of the economy.

Key Takeaway

Cyclical Value Stock Investment is a contrarian strategy that will set up excellent companies at bargain prices at the bottom of the recession. The key to success is to distance yourself from market enthusiasm and pessimism and compete within your own "circle of abilities."

Roughly speaking

- Popsy pessimism is a taste of honey: The secret to investing in cyclical stocks is that the entire industry is considered "off-the-top" and is being prepared during a recession where no one can look at it.

- Amateurs don't try it: This is a strategy for high-risk, high-return advanced players who will get serious burns if they get the timing wrong.

- The key to victory is "Winning of Ability": The only way to increase your win rate in this dangerous game is to fight in what Warren Buffett calls "an industry that you can fully understand."

Don't ride the waves of the economy, eat the "bottom" of the waves

As is classified in the source material, "Teachings from Father to Daughter," there are several types of investments. Of these, cyclical value stock investments are probably the most dynamic and most dangerous method.

Cyclical is an industry that is directly affected by the booming and recession waves, such as steel, chemicals, shipping, and real estate.

Business: Demand for products and services explodes, corporate profits grow to the blue, and stock prices rise with excitement.

Recession: Demand has faded, and profits have fallen sharply. Sometimes they fall into the red, and stock prices are left at a price that is almost like garbage.

What we are aiming for is the rock bottom of this recession. Everyone has given up on the idea that this industry is no good, and even good companies are selling their stock prices unfairly. It is similar to the act of quietly picking up treasures in the heart of a storm, rather than waiting for the storm to pass.

Why is this technique dangerous for amateurs?

It sounds good, but this strategy is extremely dangerous. Because there is always a chance that the place you thought was "bottomed" could be an even more bottomless swamp entrance.

I hope you will remember the Lehman shock of 2008. As the global economy collapses, many shipping and steel stocks have lost more than 90% of their value. Many investors decided to buy it, thinking "it's already at the bottom," but the real bottom was far ahead.

Timing risk: Even if you buy it because you think it's at the bottom, the stock price will continue to fall if the recession continues for longer.

Risk of bankruptcy: No matter how good the company is, if the recession continues for a long time, its cash flow will deteriorate, and in the worst case scenario, investment will run out of paper.

Taking a hand with half-hearted knowledge is like rowing into a stormy sea without even having a compass. So, how can individual investors like us survive this dangerous voyage?

[Graduate improvement proposal] Buffett's "Curvey of Ability" to keep risks

Here, let's borrow the wisdom of Warren Buffett, the god of investment. He argued, "Know and stay within the circle of competence."**.

"You don't have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital." - Warren Buffett

This is an absolute guide when investing in cyclical stocks. If you're an automotive engineer, you'll be able to smell the "real smell" of the automobile's economic cycle than a semiconductor industry analyst. If you're a researcher at a chemical manufacturer, you'll be able to predict the future of the materials industry more accurately than a financial person.

hint

Question to identify your "circle of abilities"

- Can you explain the technical terms in that industry in a way that even elementary school students can understand?

- Can you immediately list the five major players in the industry and their strengths and weaknesses?

- Can you talk about what the industry will be like in five years and your own grounded scenario?

If you're stuck in the answer, it's outside your "ring."

In other words, you should only focus on "cyclical stocks in industries related to your occupation or field of expertise"**. This will give you your own "information advantage" that is no less than that of professional analysts. Industry specialized magazines, conversations with fellow businesses, and business conditions. All of these things tell us the "bottom signs" that the masses will overlook.

This is a "survival strategy" called investment

When the economy is in a recession, the company can easily cut off its employees. It is a cold and rational decision to ensure that the company system survives. In that case, shouldn't we individuals have a similarly cold-hearted and rational survival strategy?

Cyclical stock investment is nothing more than an act of using the system of recession to transfer wealth to individuals. If the company cuts you off, then you too will use the market to "exploit" the company. This is a battle in a capitalist society that poses the dignity of individuals.

Conclusion: Investment is the most intelligent game beyond lonely thinking.

Cyclical Value Stock Investment is not just a money-making technique. It is an epic game where you can interpret popular psychology, identify the big economic surges, and test your own intelligence.

Rather than selling with fear, buy in the midst of fear, based on your own analysis and beliefs. That lonely decision will free you from the "salary slave" and lead you to true financial freedom.

Now, let's start thinking training. Which industry are you "experts"?

Actions you want to wake up after reading

First, I would like you to write down one of the industries you know most (the current occupation or areas you have been deeply involved in in the past) on paper. And then start by reading one related news and reports to see where the industry is currently in the economic cycle.